37+ How much can we borrow joint mortgage

Roth IRA contributions may be limited by an individuals overall income. A mortgage is an arrangement where you borrow money from a lender to buy a property whether as a home or investment such as a buy-to-let.

Land Loan Calculator And Lot Loans Macu

Given that the second tax bracket is 12 once we have taken the previously taxes 10275 away from 27050 we are left with a total taxable amount of 16775.

. In July 9709 mortgage loans were taken down from 12024 in June and 12064 in July 2021. Find a mortgage for you. Refinancing a mortgage can be costly however these costs can be recouped over time if youre refinancing to a loan with a lower interest rate.

Contact New American Funding today to see how much you can save. How Much Can You Afford to Borrow. Give us a call on 03 456 100 103 and our qualified mortgage advisors can provide you with free advice to find a mortgage.

For the purpose of backing an interest-only mortgage we can use a maximum of 15 of the latest projected value if this projection is greater than 400000. To schedule a free 15 minute consultation with one of the experienced partition attorneys at Talkov Law contact us online or by phone at 844 4-TALKOV 825568. There are no upper age limits for lifetime mortgages.

We can use a maximum of 60 of the tax free lump-sum amount provided the projection shows a minimum lump-sum available of 100000. A knowledgeable California partition attorney can help you end this joint mortgage once and for all. At age 55 you can release up to 27 of your property value increasing each year you age.

However in general you can deduct any mortgage interest that you pay on up to 750000 of debt any points you had to pay to get your mortgage or to pre-pay interest and any property taxes you pay. In this example the lender would be willing to offer a loan amount of 171000. You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call.

The maximum percentage that you can release from your home is capped at 58 from age 82. The attorneys at Talkov Law have extensive experience litigating partition cases. The perfect mortgage looks different to everyone thats why we offer a range of mortgage types and rates.

How much can I borrow. Or joint applicants with combined salaries of 75000 or where one party has an individual salary of 50000. For Final Salary schemes.

In this policy where we say cookies it can also mean similar tracking technologies that collects data while you use our websites and mobile apps and when you receive open or respond to emails we send you. It will not impact your credit score and takes less than 10 minutes. So in order to raise the full amount needed to buy the property we need to borrow money through a mortgage.

While you qualify for a lifetime mortgage at age 55 the number of equity release plans available will be restricted. If we do we will post those changes on this page within a reasonable time after the change so that you are aware of what information we collect and how we intend to use it. For 2021 and 2022 individuals can set aside up to 6000 per year those age 50 and older can save an additional 1000.

The discharge fee will generally cost between 100-400. An AIP is a personalised indication of how much you could borrow. A standard valuation fee alone can be between 200-500.

That represents a drop of 21 on the month and about the same on 2021 numbers. It also explains the choices you can make about whether we can put some types of cookies on your PC tablet or mobile phone. After taking 12 tax from that 16775 we are left with 2013 of tax.

Lenders generally prefer borrowers that offer a significant deposit. Whichever first direct mortgage you choose we could help you feel right at home. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you.

We may amend this policy from time to time. 5 Star rated over 500000 customers helped Well match you with your perfect Mortgage Advisor for free. If a house is valued at 180000 a lender would expect a 9000 deposit.

Homeowners with fixed rate mortgages face big increases in their monthly payments when they come to remortgage as average rates on both two-year and five-year deals now top 4. They typically request at least 5 deposit based on the value of the property. The term of a mortgage usually lasts between 25 and 35 years.

Despite rapid mortgage rate rises and bigger bills hampering borrowers house prices continued to rise - taking the cost of the average house to 273751. Depending on your interaction with Ascensus other privacy policies may apply in addition to this Policy. The setup fees for the new loan can cost between 300-1000.

Mortgage advisers available 7 days a week. While income tax is the largest of the costs many others listed above are taken into account in the calculation.

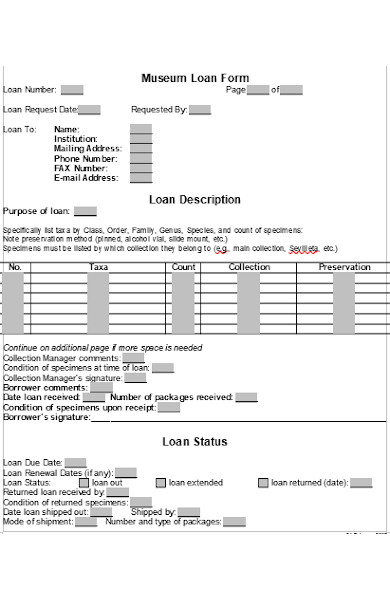

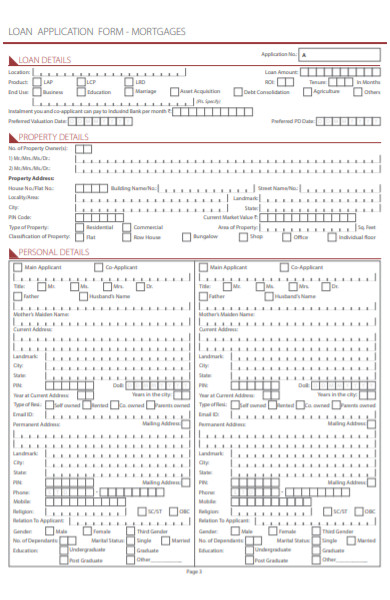

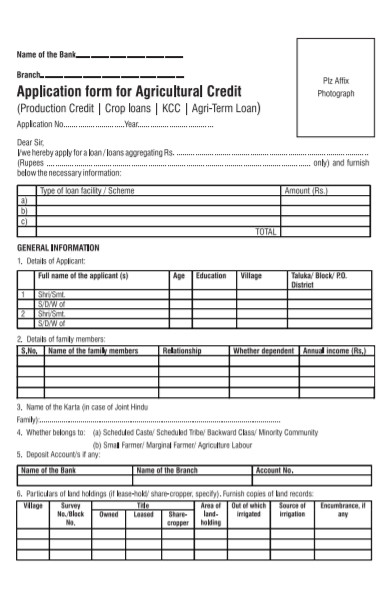

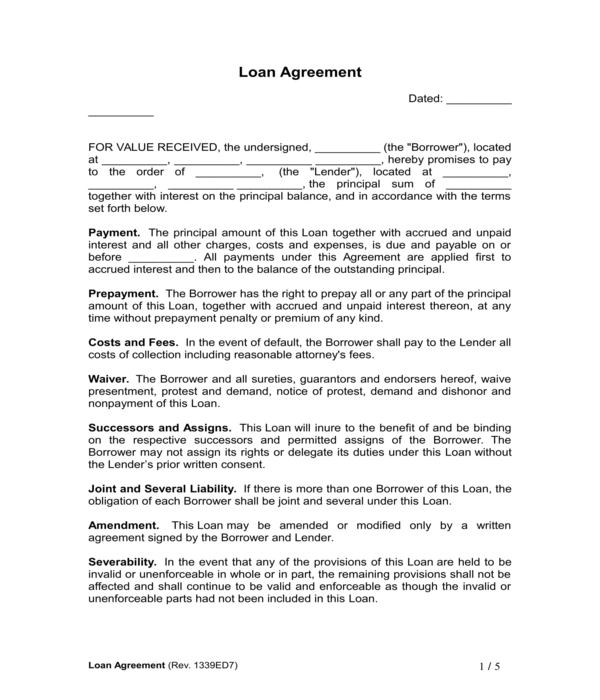

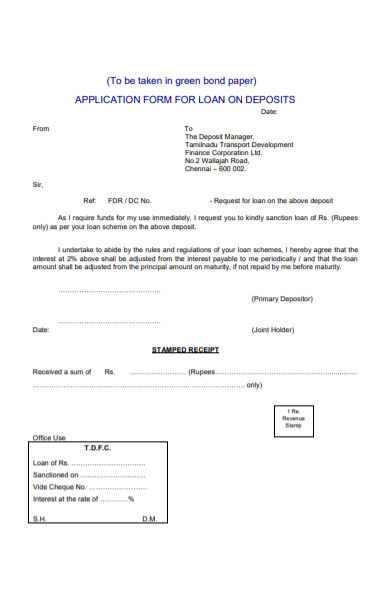

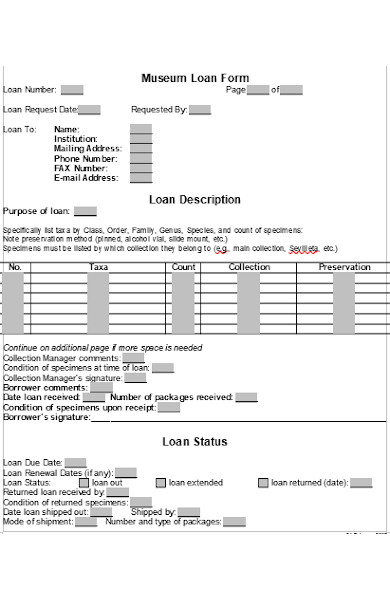

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel

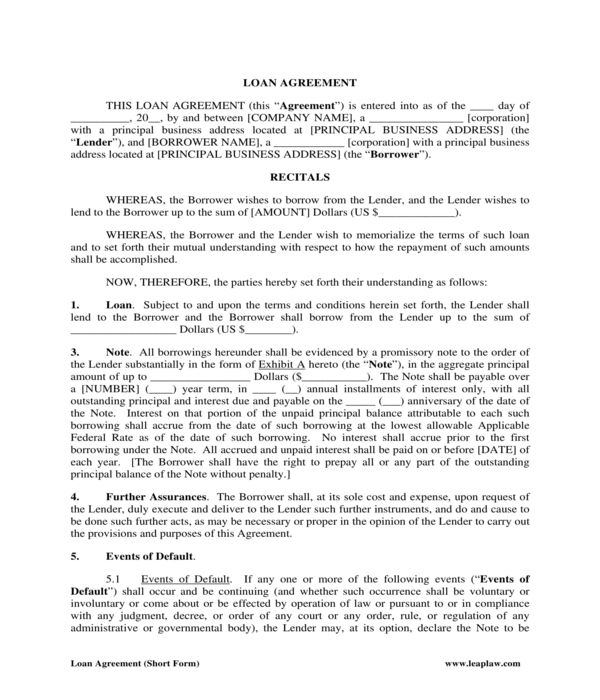

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Vintage Leaflets And Flyers Of The 1900s Page 8 Leaflet Real Estate Ads Vintage Ads

2

Pdf Forecasting Credit Card Portfolio Losses In The Great Recession A Study In Model Risk

Home Buyer S Paperwork Checklist Home Buying Process Home Buying Tips Buying First Home

Free 55 Loan Forms In Pdf Ms Word Excel

2

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

Land Loan Calculator And Lot Loans Macu

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel

Land Loan Calculator And Lot Loans Macu

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel